It's Property Tax Appraisal Season Again!

It’s that property tax appraisal season time of year again… when homeowners get a little bipolar.

It’s that property tax appraisal season time of year again… when homeowners get a little bipolar.

On one hand, they are delighted about all of the equity they have in their home and about the market value that has increased dramatically in the last couple of years… it’s an excited, “Look at how much money our home is worth!!!” On the other hand, they are less than thrilled about the tax bill that is based on the County Central Appraisal Districts valuation of their property… it’s an angry, “There’s no way our home can be valued that high!!!”

It’s just that bipolar time of the year when it comes to the value of your home.

How Do I know How Much My Appraisal Is?

The county does not look at each house in the county individually and assign a unique value to each property. Individual appraisals are extremely time-consuming and would be an impossible task on an annual basis. Instead, the appraisal district uses a mass appraisal process to place an assessed value on your real property.

The mass appraisal process usually involves compiling data regarding the physical characteristics of the property and market data such as rental rates, vacancy rates, expense rates, other income, capitalization rates, cost data, and comparable sales data. Valuations are calculated using data for each subject property with the market data. Statistical processes including regression analysis are performed to develop an estimate of value for each property. This is the process typically used by appraisal districts in Texas to estimate the assessed value for real estate.

The value placed on your home for the current tax year is calculated based on what it was valued at on January 1st of the current tax year. Once the appraisal district has the values calculated, they mail a Notice of Appraised Value to each homeowner. This year, the Notice of Appraised Value was scheduled to be mailed on Friday, April 15th; Informal appeals were scheduled to begin on Monday, April 18th; and the deadline to file a Notice of Protest on your property’s value will be Monday, May 16th.

For an in-depth look at the appraisal process and the appeal process check out When Property Tax Valuations Come Out…

How Do I Protest My Property's Value?

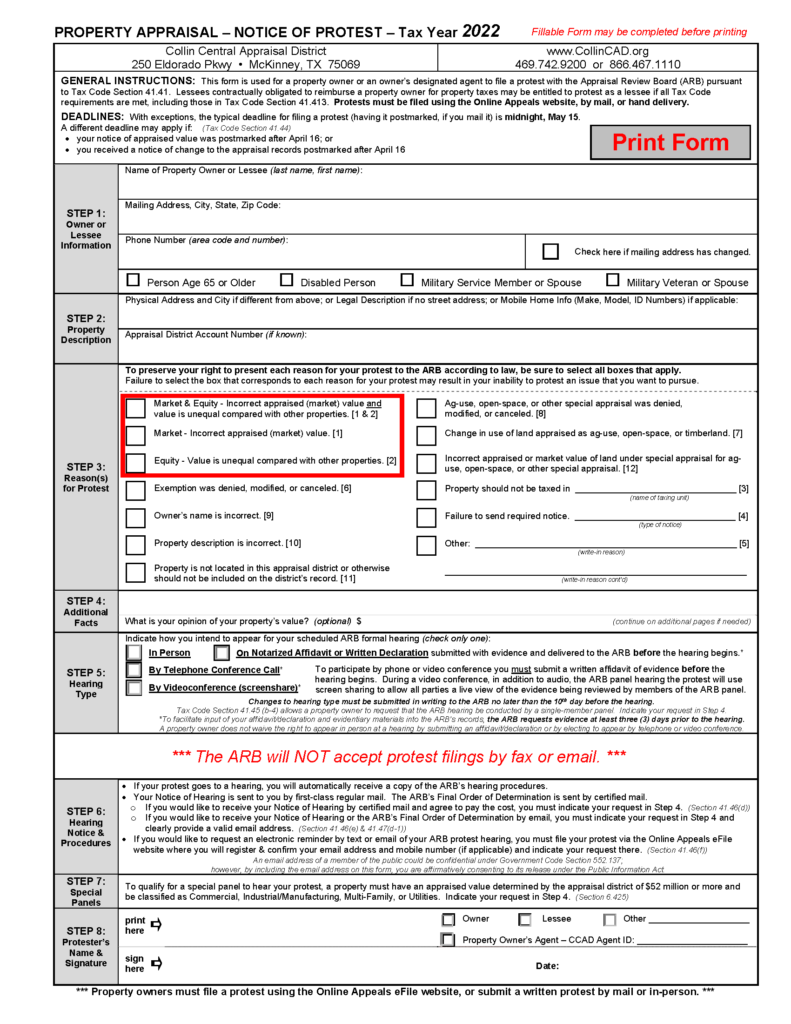

Along with the property appraisal from the county appraisal district, you received a form called Property Appraisal – Notice of Protest. Here is a copy of the Collin County form…

In Step 3, you have basically two options for protesting your valuation.

The second box is a “Market Value” protest… for this protest, you would find comparable sales, provide a Comparative Market Analysis (CMA), and use those comparable sales as the basis for stating that the appraisal district has valued your property higher than the market value of other properties like yours in your neighborhood.

The third box is an “Equity” protest… this protest states that the value the appraisal district has assigned to your home is unequal when compared to the valuation that they have placed on other comparable homes in your neighborhood.

The second box looks at the difference in “Market Values” and the third box looks at the difference in “Appraised Values”.

The appraisal district has now added the first box which allows you to mark one box and still appeal the market value and the appraised value.

How Do I Get a CMA For My Protest?

For many years I have done free market analysis for anyone that has asked and provided CMA’s based on both the market value of the property and based on the unequal appraisal of the property by the County appraisal district. I made recommendations, based on the results of the CMA’s, as to what the best course of action might be to get the appraiser to reduce the appraised value of the property for tax purposes.

I have done thousands of manual CMA’s looking for the best options to get your appraised values reduced… based on that massive amount of research…

I DON’T FEEL LIKE MANUAL CMA’s ARE VERY EFFECTIVE IN THIS CRAZY REAL ESTATE MARKET!

What's Wrong With Using The CMA's?

Any Realtor with access to the MLS can pull comparable sales and provide a market value CMA. If those same Realtors have some research skills, and are willing to spend the time researching for you, they can also find the properties with unequal appraisals.

The last couple of years has seen some dramatic increases in the market value of homes in Texas and especially in the DFW Market. According to the latest edition of Texas Housing Insights, published on April 6, 2022, by the Texas A&M Real Estate Research Center… Texas home prices are increasing at a rate of 15.6% annually. Their research stated, “The ongoing shift in the composition of sales toward higher-priced homes, due to the constrained inventories at the lower end of the market, boosted the average and median home prices.”

The median price of a home in DFW was $365,000 and represented a 17.4% annual increase. The North Texas Real Estate Information System (NTREIS) data for March 2022 indicates that the average sales price in Collin County is up 30.3% and the Rockwall County Average price is up 18.6%.

State law limits the increase in the appraised value of residential property with homestead exemptions to 10% per year.

With the dramatic double digit increases in the purchase prices of residential property our real estate market has seen, the market value of residential property is far outpacing the artificially restricted appraised value used by the county appraisal districts. As homes are purchased, the appraisal district is allowed to increase the value of the newly purchased property to it’s current market value during the first year of ownership. If you have owned your home for as little as two years… it is likely that the 10% increase in appraised value that you receive on your valuation from the appraisal district is still below the actual market value that would be indicated on a market value CMA.

When looking at unequal appraisals, it is getting more difficult to find comparable homes that are valued lower than the subject home by using the manual processes available to Realtors using the MLS to do the research.

Here's What I Did This Year...

I’ve protested the value the appraisal district has placed on my home every year for as long as I can remember. It seems to me, their 10% limit will always be lower if I protest and keep the appraised value as low as possible… and I let those small reductions in value compound over time.

This year… I didn’t even look at a CMA for my own house.

In the era of big data, my manual processes aren’t as effective as corporations that aggregate data and use artificial intelligence to find the best possible comps to protest the value of my property.

Instead of protesting the value myself, I partnered with Home Tax Shield to do all of the work for me. Home Tax Shield costs $30 on the front end and they will charge you later for 30% of the savings that they get from reducing the assessed value of your property… that 30% fee will be due in October or November when the valuations have been finalized.

Here’s how using Home Tax Shield works…

It really only took a couple of minutes to set it up and Home Tax Shield will do all of the rest of the work… They will email you a form authorizing them to represent you in the property value protest process… and then they will represent you all the way through the formal appraisal review process to get you the largest possible reduction in your home’s appraised value.

Home Tax Shield partners with Realtors to drive business their way. If you use the links provided in this blog the front-end cost will be cut in half… the front-end fee will only be $15 and they will charge you the 30% later when the assessed values are finalized.

Full Disclosure: Home Tax Shield does offer a small referral fee for sending people through the links in this post… that is NOT my motivation for referring this company. FireBoss Realty will not keep the referral fee… instead, we will donate any referral fee received from Home Tax Shield to the Books for Prisoners Program through Randy Alcorn’s Eternal Perspective Ministries.

If you don’t want to use the referral link, you can always just google Home Tax Shield and pay the full price for their services. There are numerous services that will file your tax value protest for you… after researching them, I decided that Home Tax Shield provided the best services for the money.

I hope this helps you save a little bit of money on your property taxes…

If you choose to use Home Tax Shield, I’d love some feedback on your experience with this company!

FireBoss Realty would love to help you if you are looking for Homes for sale in Wylie, Homes for sale in Sachse, Homes for sale in Murphy, Homes for sale in Lucas, Homes for sale in Allen, Homes for sale in McKinney, Homes for sale in Plano, Homes for sale in Rowlett or Homes for sale in Collin County.

FireBoss Realty is a real estate team operated by Texas Realtors Scott and Amie Johnson under the brokerage of Keller Williams Central/75. Each Keller Williams office is independently owned and operated.