Many first-time homebuyers are caught off-guard when they learn the term “closing costs” and what it means for them. But what are they, how much are they, and when are they due?

Closing costs, which are separate from your down payment, can be a major expense for buyers, so it’s important to be aware of them and plan accordingly. By understanding what they are and when they’re due, you can avoid any surprises at the closing table. Here’s a list of some of the most common closing costs.

What Are Closing Costs on a Home Purchase?

Closing costs are expenses that are incurred by both the buyer and seller in a real estate transaction. They generally include items such as the cost of obtaining a mortgage, title insurance, appraisal, inspection, real estate taxes, and more.

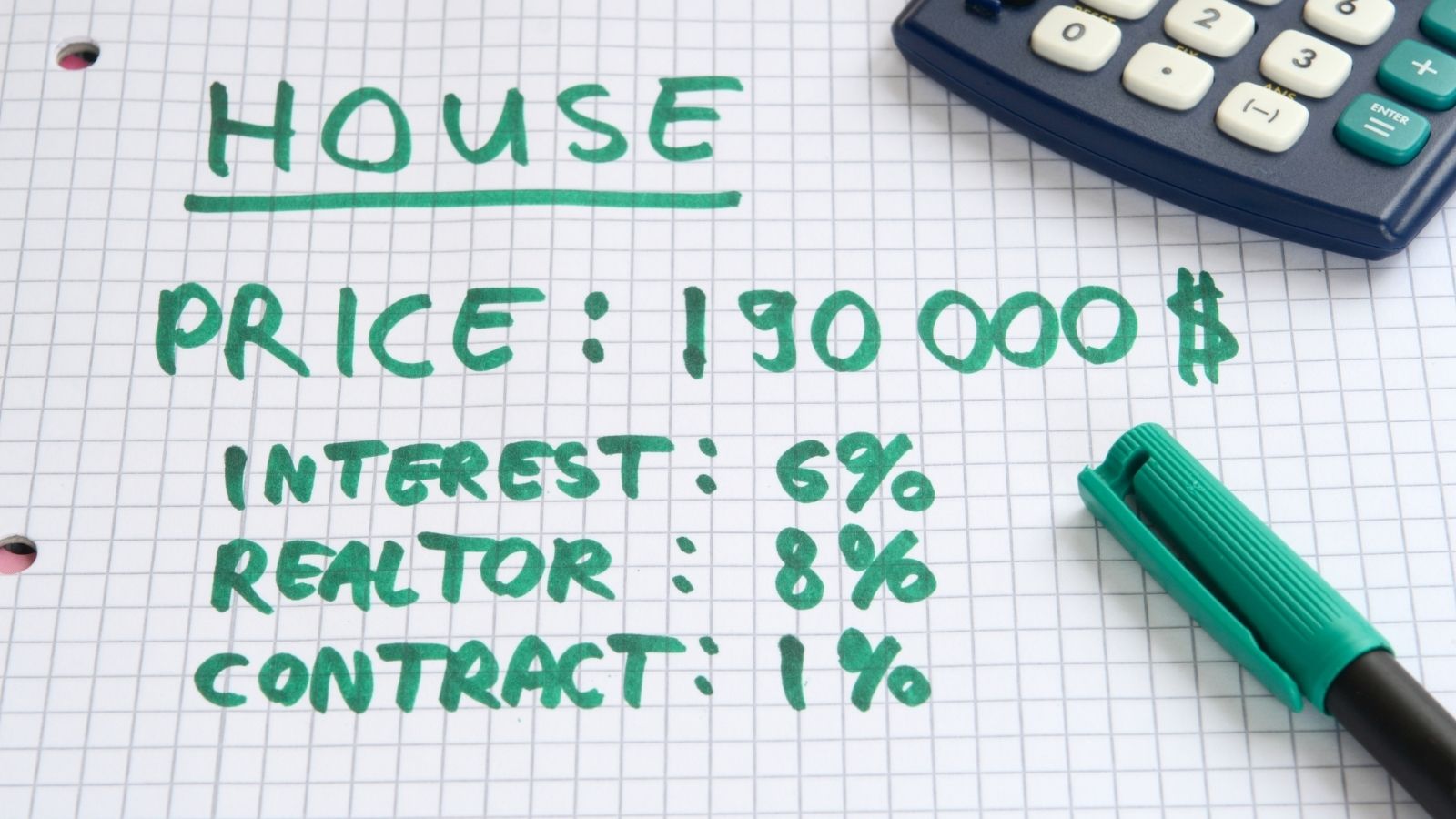

How Much Are Closing Costs?

Closing costs usually amount to between 2% and 5% of the purchase price of a home. However, they can vary significantly depending on the location of the property, the terms of the sale, and the type of mortgage being used. This means that if you’re purchasing a $300,000 home, your closing costs will be between $6,000 and $15,000.

When Do I Have to Pay Closing Costs?

Most closing costs must be paid at or before closing, which is typically when the property ownership is transferred to the buyer from the seller.

Can I Finance My Closing Costs with My Mortgage?

In most cases, closing costs are a cash-out-of-pocket expense. There are, however, a few lenders who might allow you to finance a portion of your closing costs into your mortgage. This can be a helpful way to spread out the cost of buying a home over time.

Can I Negotiate Closing Costs with the Seller?

Yes, you can often negotiate with the seller to have them pay some or all of your closing costs. Keep in mind, though, that the seller may be less willing to do this if they are already offering a discounted price on the home or if they have other fair offers to consider.

Compare Lenders

Lenders are responsible for a large portion of closing costs with lender fees. It’s the lender who provides you a list of estimated closing costs, which you can then compare with other lenders. You may find that with estimates from at least three lenders, you may be positioned to negotiate lower closing costs.

Common Closing Costs

This list includes some of the most common closing costs associated with residential real estate but is in no way a comprehensive list. For more information about closing costs, talk with your real estate agent.

Application Fee: This is a fee charged by the lender to process your mortgage application.

Credit Report Fee: This is a fee charged by the credit reporting company to prepare your credit report.

Loan Processor Fee: This is a fee charged by the lender to oversee and coordinate your mortgage transaction.

Underwriter Fee: This is a fee charged by the lender for assessing your loan application and issuing final approval.

Title Insurance: This is an insurance policy designed to protect the buyer against losses that may occur due to errors in the title of the property.

Escrow Fees: These are fees charged by the escrow company to handle the transfer of funds and documents between the buyer and seller.

Mortgage Broker Fee: This is a commission paid to the mortgage broker for finding a suitable mortgage loan for you.

Attorney Fee: This is a fee paid to the attorney who represents either the buyer or seller in a real estate transaction.

Real Estate Tax: This is the real estate tax that is due on the property you are purchasing.

Appraisal: This is a fee charged by the appraiser to estimate the value of the property.

Inspection: This is a fee charged by the inspector to assess the condition of the property.

Survey: This is a fee charged by the surveyor for preparing a plot plan for the property.

Homeowner’s Insurance: This is the insurance policy that will protect your home and belongings in the event of a fire, theft, or other covered loss.

Flood Insurance: If you are purchasing property in a designated flood zone, you may incur an additional fee for this insurance.

Fire insurance: If the property you are purchasing is located in a high-risk fire area, you may be required to purchase additional fire insurance.

Prorated Property Taxes: This is the portion of the current year’s taxes that are paid for the time period between when you take ownership of the property and the end of the year.

Pre-paid Property Taxes: If your escrow payment includes taxes, there may be additional fees charged for pre-paying those taxes now instead of waiting until tax season.

Pre-paid Interest (Points): This is a fee paid at closing for reducing the interest rate on your mortgage.

Don't Forget Moving Expenses

In addition to your closing costs, don’t forget to budget for your moving expenses. These can vary greatly depending on how far you are moving and the size and type of truck you need. If you’re hiring professional movers, expect to pay anywhere from $500 to $2,000 or more.

A Nest Egg for Unforeseen Expenses

In any real estate transaction, there are unforeseen expenses, whether those are added closing costs, utility deposits, or home repairs. Be sure to set aside a little extra money in your budget when purchasing a home to cover these expenses.

The Bottom Line

Some first-time homebuyers miss out on their buying opportunity because they weren’t prepared for closing costs.

While it’s impossible to know with certainty what fees you’ll be required to pay, it is possible to estimate the costs and set aside money in your budget.

Ask your real estate agent for more information about expected closing costs in your area.