Late last year, Texas voters approved Senate Bill (SB) 1801, an $18 billion property tax relief package that lawmakers in Austin grappled with for several months and multiple special sessions. Those property tax cuts and changes to exemptions will take effect this year when the tax bills come out in the fall.

Texas Property Tax Relief

The legislation talks about providing tax relief through “compression” but all that really means is that the State will provide more funding to the schools so the school districts can cut taxes for homeowners. Compression was one of Governor Abbotts priorities and actually began in 2019. However, the new property tax legislation provides for an additional 10.7 cents per $100 of valuation or $107 for every $100,000 of taxable valuation placed on your home by your county’s central appraisal district.

Increased Homestead Exemption

With this new legislation, the Texas homestead exemption will also more than double from $40,000 to $100,000. That’s an additional $60,000 exemption on the taxable value of an owner-occupied property.

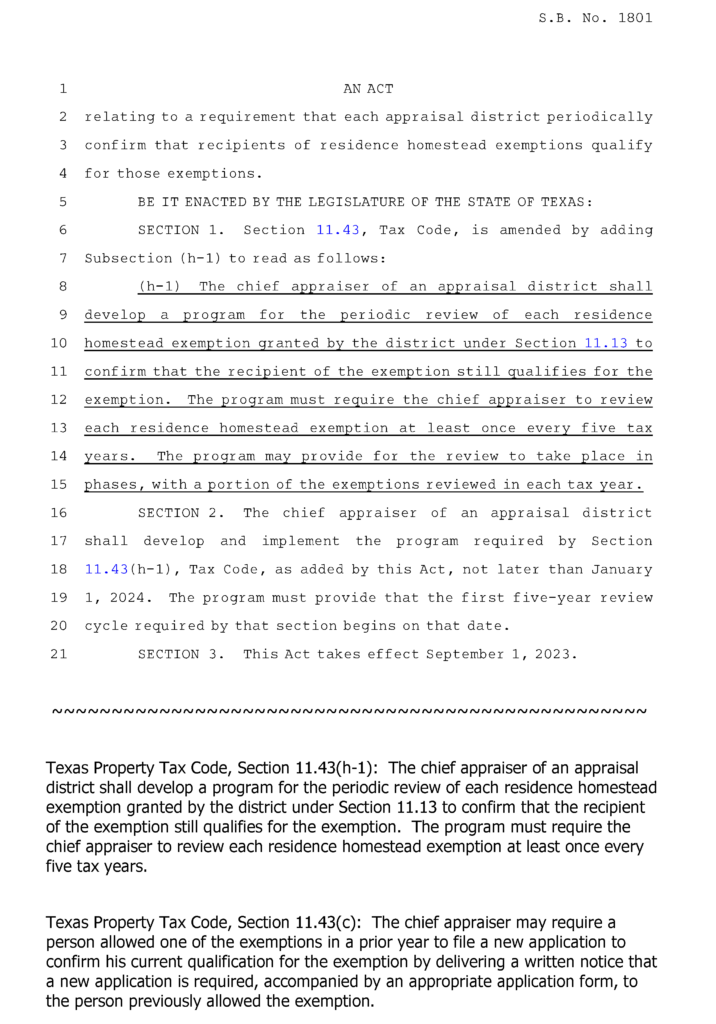

In the past, filing for your homestead exemption was a one-and-done process. The new legislation now requires each county’s central appraisal district to verify the validity of each residential homestead exemption at least every 5 years to confirm the recipient of the exemption still qualifies.

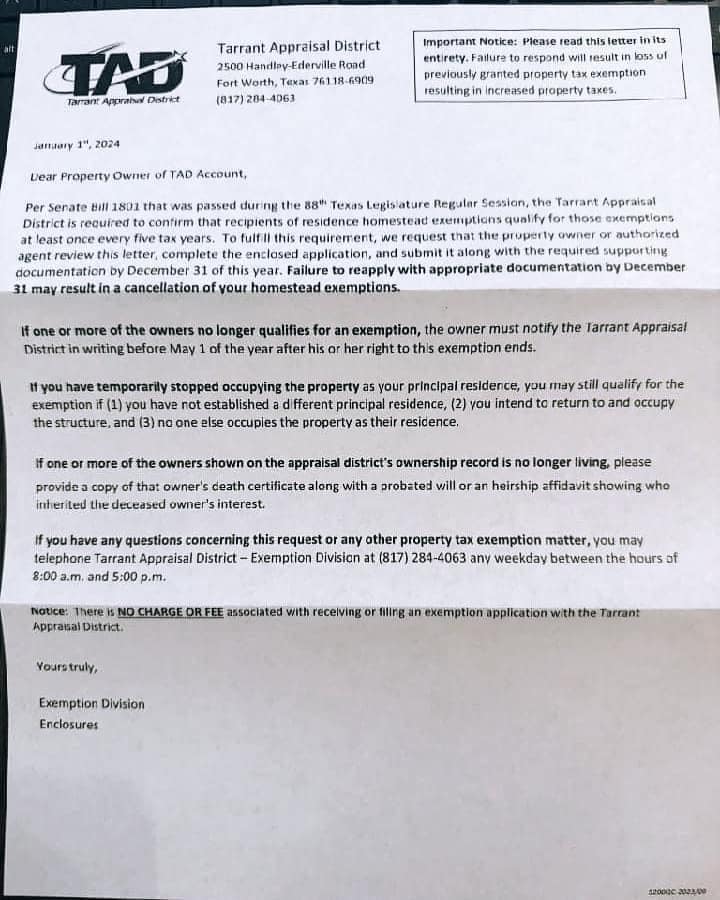

After contacting most of the local central appraisal districts, it sounds like the central appraisal districts will now be sending a letter with the homestead exemption form to individual property owners asking them to refile for their homestead exemption on a five-year basis.

IF YOU RECEIVE THIS LETTER…

FILL OUT THE FORM AND RETURN IT TO THE APPRISAL DISTRICT…

FAILURE TO DO SO WILL RESULT IN THE HOMESTEAD EXEMPTION BEING REMOVED FROM YOUR TAX RECORDS.

This could be a very costly oversight when the tax bills arrive in the fall.

There is no cost or filing fee for filing for a homestead exemption. If you get something in the mail asking you to pay a $50 – $500 fee to file for your homestead exemption, it’s a scam… throw it in the trash and go to the Central Appraisal District website and look under forms for a homestead exemption. If you can’t find it, call one of us at FireBoss Realty and we’ll be happy to help you find everything you need to file your homestead exemption.

Here is a copy of the letter that was sent out this year by the Tarrant Appraisal District…

What is the Homestead Cap?

A homestead cap value applies to residential homesteads only and it goes into effect the second year after the residential homestead as been granted for your residence. Once you have a residential homestead exemption, the taxable appraised value of your home may NOT exceed the sum of:

- 10% of the appraised value of the property for the preceding tax year; plus

- the appraised value of the property for the preceding year; plus

- the market value of all new improvements to the property.

Over 65 and Disabled Exemptions

Under the new legislation, homeowners who are over 65 years of age or who qualify as disabled will be eligible for a homestead exemption of $110,000.

SB 1801 also made adjustments to the “tax ceiling” for those who are over 65 or disabled. (Some call this a tax freeze.)

Part of the complexity of the over 65 exemption is that the math for calculating the tax ceiling (where school taxes are frozen) uses the homestead exemption amount. So the fact that it went up from $40K to $100K means ceilings had to be adjusted…lower.

Here’s one example that might further help explain the language: say you had a $175,000 house. The ceiling prior to 2023 would be the school tax due at the time they were 65… so $175,000 minus $40,000 X school tax rate would have given them their school tax ceiling. So the school taxes would have been frozen based on a $135K value. Now that person’s school taxes would be frozen on a $65,000 value ($175,000 minus $110,000), so their ceiling dropped (which is good).

It is also important to remember, only the school taxes are frozen… all of the other taxes can and do go up with values which is why it is still important for over 65 or disabled owners to protest the taxable value of their home when it comes out.

Appraised Values Are Mailed on April 15th

It’s about that time of year for homeowners to become a little bi-polar. Normally, homeowners are placing a higher value on their home than what the market actually indicates. However, when the taxable values are mailed by the appraisal district, on APRIL 15th, they flip the switch and say, “There’s no way my house is worth that much!”

The appraisal district understands that and even sends the form to protest the value of your home in the same envelope with the valuation statement.

I do recommend protesting the value of your home EVERY YEAR.

In the past, I have looked up the comps, made my case in the informal protest process, and did pretty well… then the price escalation on market values hit. With the DFW market seeing 11%+ increases in market value and the homestead cap at 10%… it became very difficult to win a protest because of the homestead exemption cap loss.

That’s when I started out-sourcing the protest process to Home Tax Shield.

For the last several years, we’ve let Home Tax Shield do all of our property tax protesting for us. If you’ve never used them before, it literally takes 2 minutes to sign up, a $30 filing fee, plus 30% of any tax savings that they may achieve. Clicking any of these links will take you to the Home Tax Shield website and you can decide if this is a service that would benefit you.

For the last several years, we’ve let Home Tax Shield do all of our property tax protesting for us. If you’ve never used them before, it literally takes 2 minutes to sign up, a $30 filing fee, plus 30% of any tax savings that they may achieve. Clicking any of these links will take you to the Home Tax Shield website and you can decide if this is a service that would benefit you.

If you are a first time user, using these links will get you a 50% reduction in the filing fee… only $15!

Full disclosure: These are affiliate links and Home Tax Shield does send a check at the end of the year based on how many people use this link. We don’t refer them for the money, we refer them because they are really good at what they do and Home Tax Shield makes it super simple to file a protest.

100% of the money we receive from this affiliate link is donated to Eternal Perspective Ministries (EPM). Randy Alcorn and EPM were instrumental in helping us understand the true value of money and possessions and we enjoy helping others find the the eternal perspective that EMP provides.

Property tax valuation season is just around the corner… hopefully, you will see a little tax break from the new legislation in SB 1801!

Oh, By The Way...

Oh by the way… we’re never too busy for any of your referrals!

If you hear any of your friends or family talking about buying or selling a home, give us a call with their name and number and we’ll be happy to follow up.

We promise to take great care of them and to treat them just like family!

Have More Questions?

FireBoss Realty would love to help you if you are looking for Homes for sale in Wylie, Homes for sale in Sachse, Homes for sale in Murphy, Homes for sale in Lucas, Homes for sale in Allen, Homes for sale in McKinney, Homes for sale in Plano, Homes for sale in Rowlett or Homes for sale in Collin County.

FireBoss Realty is a real estate team operated by Texas Realtors Scott and Amie Johnson under the brokerage of Keller Williams Central/75. Each Keller Williams office is independently owned and operated.