Ever Wonder Why Your Mortgage Payment Went Up?

Ever opened your mortgage statement and wondered, “Why did my payment go up?”

Many times, rising property taxes play a major role.

Here’s why: Your mortgage payment includes principal, interest, taxes, and insurance — often called PITI.

The principal (the amount you borrowed) and the interest (the lender’s fee) usually stay the same, unless you have an adjustable-rate mortgage.

However, the taxes and insurance amounts can change each year.

If your property taxes or homeowner’s insurance go up, your lender adjusts your monthly mortgage payment to make sure your escrow account has enough money to pay those bills when they come due.

Whether you’re new to Wylie or have lived here for years, understanding how property taxes work is key to managing your budget and feeling confident about your home expenses. Let’s dive in!

Where Your Money Really Goes

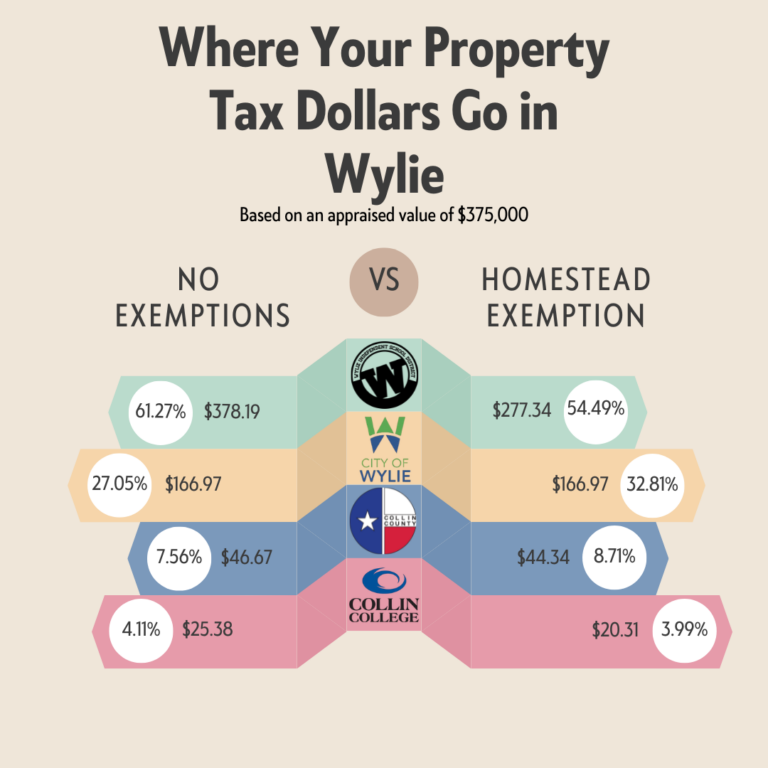

If you own a home in the Wylie ISD area, you’re paying property taxes to:

- City of Wylie

- Wylie Independent School District (Wylie ISD)

- Collin County

- Special districts (such as Collin College, depending on your location)

These taxes help fund:

- Public schools

- Police and fire departments

- Parks, libraries, and road maintenance

- Community colleges and local programs

How Property Taxes Are Calculated

Here’s the basic formula:

(Appraised value – Exemptions) × Tax rate = Property Tax Due

Each spring, the Collin County Appraisal District (CCAD) estimates your home’s market value.

The total tax rate includes city taxes, school taxes (Wylie ISD), county taxes (Collin County), and any special district taxes.

💡 Example:

- Your home is appraised at $375,000.

- You qualify for the $100,000 Texas Homestead Exemption.

- Your taxable value becomes $275,000.

- If your total tax rate is 2.5%, you would pay about $6,875 in property taxes annually.

(Note: City and county portions may offer their own additional exemptions, so always double-check with your county.)

Why Understanding Property Taxes Pays Off

And while no one loves paying taxes, knowing how it all works can help you:

- Budget smartly: Avoid unexpected jumps in your escrow account.

- Plan better: Make informed choices when buying, refinancing, or moving.

- Save money: Apply for exemptions and appeal your appraisal if needed.

Key Property Tax Tips for Wylie Families

✅ Homestead and Other Exemptions

If you live in your home as your primary residence, you likely qualify for the Texas Homestead Exemption, reducing your taxable school value by $100,000.

Other exemptions may apply if you are:

- Age 65 or older

- A veteran

- An individual with a disability

You can apply for exemptions through the Collin County Appraisal District.

✅ Annual Trends to Watch

Even if the tax rate stays steady, your tax bill can rise if your home’s appraised value increases.

Given Wylie’s steady growth, it’s important to review your annual notice and confirm the value.

✅ You Can Appeal Your Appraisal (But Don’t Miss the Deadline!)

If you believe your home’s appraised value is too high, you have the right to file a protest with the Collin County Appraisal District.

Important:

You must file your protest no later than May 15th (or within 30 days of receiving your appraisal notice, whichever is later).

Missing this deadline means you’ll have to wait until next year.

Considering an Appeal?

Curious about what the protest process looks like?

Check out this blog post by Scott.

You can read it all or jump straight to the “Here’s What I Did This Year…” section if you are looking for a quick way to protest your appraised value.

Staying Ahead of Your Property Taxes

Property taxes don’t have to be confusing or overwhelming.

When you understand the basics — and take advantage of helpful resources — managing your family’s finances becomes so much easier.

If you ever have questions about homeownership, property taxes, or life around the Wylie ISD area, you’ll find lots of friendly advice on our blog.

And of course, we’re always just a call or message away if you need a little extra help!

FireBoss Realty is a real estate team operated by Texas Realtors Scott and Amie Johnson under the brokerage of Keller Williams Central/75. Each Keller Williams office is independently owned and operated.