Baby Step # 5 – College Funding for Your Children

When you get to Baby Step #5 you’ve used the Debt Snowball to get out of debt, you’ve fully funded 3 to 6 Months of Expenses into your Emergency Fund and you’re Investing 15% of Your Household Income into appropriate retirement accounts. Now we want to start thinking about how we are going to get the kids through college without using student loans.

Before we get too far I want to go on the record as saying,

Going To College After Graduating From High School Is Not For Everyone!

Some kids need to mature before taking on the responsibility of college. Some kids need to take a break from education after they finish high school. Some kids just need to find a job, go to work and not even think about going to college.

I’m all for education. I believe that leaders are learners and that people should engage in lifelong learning. I just don’t believe that a four year college is the only place that you can get an education. I also don’t think it’s worth $20,000 to $50,000 per year for a kid to go to college and earn a PhD if those letters stand for Party hardy Daily (PhD).

Having said that, in order to have enough money saved for college, you need to have a goal. Determine how much you should be saving at 12% interest in order to have enough for college. If you save at 12% and inflation is at 4%, then you are moving ahead of inflation at a net rate of 8% per year!

The best way to save for college is with Education Savings Accounts (ESAs) and 529 plans. Avoid using insurance policies, Savings bonds or Pre-Paid College Tuition.

It is possible to go to college without going into debt!

Here are a few ideas to help make that happen…

Start at a Community College

Start at a Community College

Consider taking Core Classes at a local community college. Community Colleges are generally more affordable, the credits transfer to four year colleges and they are typically close enough to live at home. It’s always a good idea to meet with a college counselor to be sure that the credits will transfer to the four year college that you plan to attend. Need help calculating the difference between living at home, living on campus or living off campus? Here’s a College Living Expense Calculator that you can use.

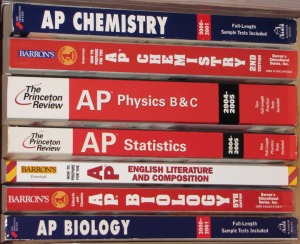

Take Advanced Placement (AP) Classes and Exams in High School

Compared to the cost of college tuition this is a great deal! Taking AP classes in high school is free and the exam to receive college credit is less than $100. If you want to know more about AP classes and exams check out AP Central.

Buy Used Books

Books are an income stream for colleges and they love to sell them for a lot and buy them back for very little. Whenever possible, buy used books. You don’t even have to get your books from the college book store. When it’s time to buy books, you can find some great deals online from textbooks.com, bn.com, amazon.com, and biblio.com. You may even want to explore renting textbooks at chegg.com. Be sure to check the ISBN numbers and make sure that you are getting the correct edition.

Find FREE Money

There’s a scholarship for almost everyone! With the internet at your fingertips you have the resources to do your research and apply early. This might sound crazy but start looking for scholarships when your kids are in middle school or even earlier. You aren’t going to apply that early but you will get an idea of what is available and whatever your kids are interested in, you can direct their activities to achieve the benchmarks required for some of the scholarships that are available. It’s a little late to run for a seat on the student council after you’ve graduated high school. Here are some great websites to get started with your search.

Here’s My Favorite… Your Student Needs A Job!

It sounds almost counter-intuitive but your student needs to work their way through school. We’re not talking about a full time job but studies on The Impact of Student Employment have shown that students who work 20 hours or less per week on campus report higher levels on all five levels of engagement studied. They showed higher student-faculty interaction and more engagement in active and collaborative learning.

College is expensive but student loan debt has been to most common denominator in all of the financial counseling that we’ve done. Our culture has built an expectation of attending college immediately after high school and we have normalized financing the cost. It doesn’t have to be that way. Just like all of the other behaviors that we have learned to this point –

You have to have a financial plan to get through college debt free!

Make a college funding plan and work your plan!

Who knows, if they don’t use the funding for college you can use that money to __________________________! (Fill in the blank)

Related articles

- 3 Tips on How Much to Save for Your Kids College Fund (turbotax.intuit.com)

- Study: Parents are funding less of their kids’ college tuition (cbsnews.com)

- You Don’t Have To Be A Millionaire To Graduate College Debt-Free (businessinsider.com)

- TurboTax – Cash for College: Tax-Free 529 Plans (turbotax.intuit.com)

- Four in 10 now borrow for college; worries of next debt crisis (thetimes-tribune.com)